Let’s get one thing out of the way: the plagiarism debate is a red herring. It’s a convenient distraction, an intellectual sleight-of-hand designed to keep us arguing in circles while the real game unfolds elsewhere.

Framing the conversation around whether AI “plagiarizes” is like asking if a vacuum cleaner steals the dust. It misunderstands the scale, the mechanism, and—most critically—the intent. Plagiarism is a human ethical violation, rooted in the act of copying another’s work and passing it off as your own. Extraction, by contrast, is systemic. It is the automated, industrial-scale removal of value from cultural labor, stripped of attribution, compensation, or consent.

To conflate the two is not just sloppy thinking—it’s useful sloppiness. It allows defenders of these systems to say, “But it doesn’t copy anything directly,” as if that settles the matter. As if originality were the only axis of concern. As if we hadn’t seen this move before, in every colonial, corporate, and computational context where taking without asking was rebranded as innovation.

When apologists say “But it’s not copying!” they’re technically right and conceptually bankrupt. Because copying implies there’s still a relationship to the original. Extraction is post-relational. It doesn’t know what it’s using, and it doesn’t care. That’s the efficiency. That’s the innovation. That’s what scales.

Framing this as a plagiarism issue is like bringing a parking ticket to a climate summit. It’s a categorical error designed to keep the discourse house-trained. The real question isn’t whether the outputs resemble human work—it’s how much human labor the system digested to get there, and who’s cashing in on that metabolized culture.

Plagiarism is an ethical dilemma. Extraction is an economic model. And pretending they belong in the same conversation isn’t just dishonest—it’s a smoke screen. A high-gloss cover story for a system that’s built to absorb everything and owe nothing.

This isn’t about copying—it’s about enclosure. About turning the commons into training data. About chewing up centuries of creative output to produce a slurry of simulacra, all while insisting it’s just “how creativity works.”

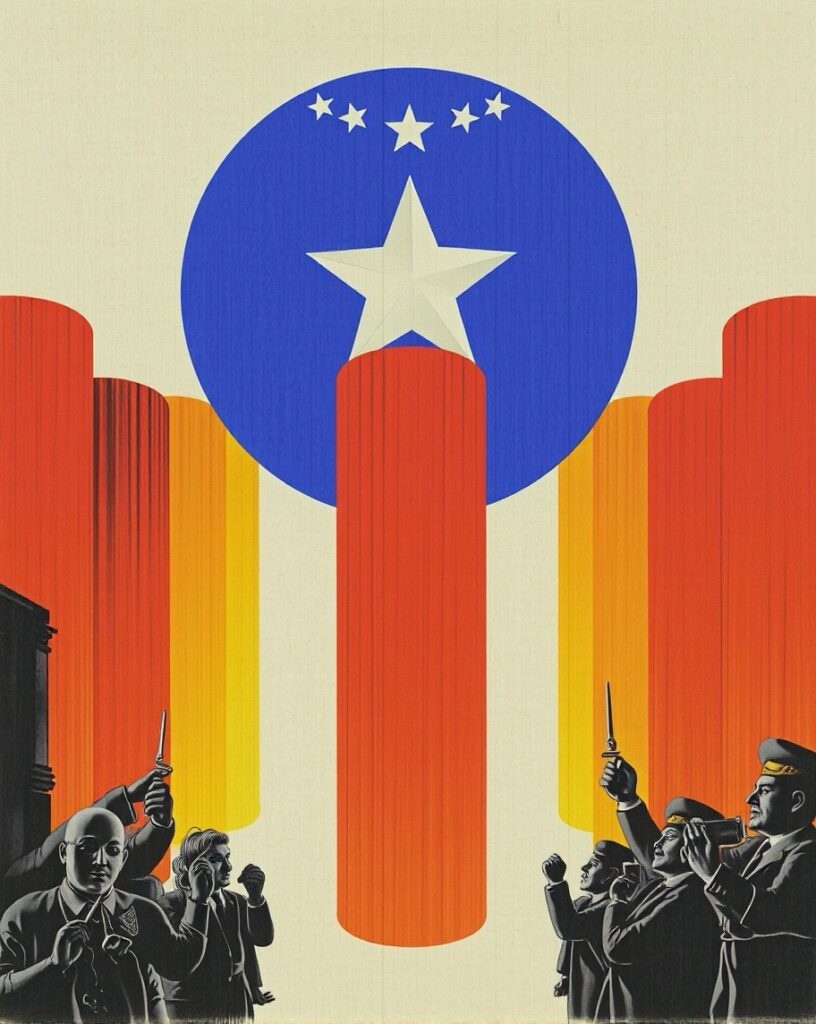

ARCHITECTURES OF CONTRADICTIONS

There’s a particular strain of technological optimism circulating in 2025 that deserves critical examination—not for its enthusiasm, but for its architecture of contradictions. It’s not your garden-variety utopianism, either. No, this is the glossier, TED-stage, venture-backed variety—sleek, frictionless, and meticulously insulated from its own implications. It hums with confidence, beams with curated data dashboards, and politely ignores the historical wreckage in its rear-view mirror.

This optimism is especially prevalent among those who’ve already secured their foothold in the pre-AI economy—the grizzled captains of the tech industry, tenured thought leaders, and self-appointed sherpas of innovation. Having climbed their particular ladders in the analog-to-digital pivot years, they now proclaim the dawn of AI not as a rupture but as a gentle sunrise, a continuum. To hear them tell it, everything is fine. Everything is fine because they made it.

They speak of “augmenting human creativity” while quietly automating the livelihoods of everyone below their tax bracket. They spin glossy metaphors about AI “co-pilots” while pretending that entire professional classes aren’t being ejected from the cockpit. They invoke the democratization of technology while consolidating power into server farms owned by fewer and fewer actors. This isn’t naiveté—it’s a kind of ritualized, boardroom-friendly denialism.

The contradiction at the core of this worldview isn’t just cognitive dissonance—it’s architecture. It’s load-bearing. It is built into the PowerPoint decks and the shareholder letters. They need to believe that AI is an inevitable liberation, not because it’s true, but because their portfolios depend on it being true. And like all good architectures of belief, it is beautiful, persuasive, and profoundly vulnerable to collapse.

THE ARCHITECTS PARADOX

Those who warn us about centralization while teaching us how to optimize for it are practicing what I call the Architect’s Paradox. They design the layout of a prison while lamenting the loss of freedom. These voices identify systemic risks in one breath and, in the next, offer strategies to personally capitalize on those same systems—monetize the collapse, network the apocalypse, syndicate the soul.

This isn’t mere hypocrisy—it’s a fundamental misalignment between diagnosis and prescription, a kind of cognitive side-channel attack. Their insights are often accurate, even incisive. But the trajectory of their proposed actions flows in the opposite direction—toward more dependence, more datafication, more exquisitely managed precarity.

It’s as if they’ve confused moral awareness with moral immunity. They believe that naming the system’s flaws somehow absolves them from reinforcing them. “Yes, the algorithm is eating culture,” they nod sagely, “now let me show you how to train yours to outperform everyone else’s.”

They aren’t saboteurs. They aren’t visionaries. They are engineers of influence, caught in a recursive feedback loop where critique becomes branding and branding becomes power. To them, every paradox is a feature, not a bug—something to be A/B tested and leveraged into speaking fees.

They warn of surveillance while uploading their consciousness to newsletter platforms. They caution against monopolies while licensing their digital selves to the very monopolies they decry. Theirs is not a vision of reform, but of survival through fluency—fluency in the language of systems they secretly believe can never be changed, only gamed.

In this paradox, the future is not built. It is hedged. And hedging, in 2025, is the highest form of virtue signaling among the clerisy of collapse.

REVISIONISM AS DEFENSE

Notice how certain defenses of today’s algorithmic systems selectively invoke historical practices, divorced entirely from the contexts that gave them coherence. The line goes something like this: “Art has always been derivative,” or “Remix is the soul of creativity.” These are comforting refrains, weaponized nostalgia dressed in academic drag.

But this argument relies on a sleight-of-hand—equating artisanal, context-rich cultural borrowing with industrial-scale computational strip-mining. There is a categorical difference between a medieval troubadour reworking a melody passed down through oral tradition and a trillion-parameter model swallowing a century of human expression in a training set. One is a gesture of continuity. The other is a consumption event.

Pre-modern creative ecosystems weren’t just derivative—they were participatory. They had economies of recognition, of reciprocity, of sustainability. Bardic traditions came with honor codes. Patronage systems, while inequitable, at least acknowledged the material existence of artists. Folkways had rules—unspoken, maybe, but binding. Even the black markets of authorship—the ghostwriters, the unsung apprentices—knew where the lines were, and who was crossing them.

To invoke these traditions while ignoring their economic foundations is like praising the architecture of a cathedral without mentioning the masons—or the deaths. It’s a kind of intellectual laundering, where cultural precedent is used to justify technological overreach.

And so the defense becomes a kind of revisionist ritual: scrub the past until it looks like the present, then use it to validate the future. Aesthetics without economics. Tradition without obligation. This is not homage. It’s an erasure wearing the mask of reverence.

What we’re seeing in 2025 isn’t a continuation of artistic evolution. It’s a phase change—a transition from culture as conversation to culture as input. And no amount of cherry-picked history will make that palatable to those who understand what’s being lost in the process.

THE PRIVILEGE BLIND SPOT

Perhaps most telling is the “I’m fine with it” stance taken by those who’ve already climbed the ladder. When someone who built their reputation in the pre-algorithm era claims the new system works for everyone because it works for them, they’re exhibiting what I call the Privilege Blind Spot. It’s not malevolence—it’s miscalibration. They mistake their luck for a blueprint.

This stance isn’t just tone-deaf—it’s structurally flawed. It ignores the ratchet effect of early adoption and pre-existing capital—social, financial, and reputational. These individuals benefited from a slower, more porous system. They had time to develop voices, accrue followers organically, and make mistakes in relative obscurity. In contrast, today’s creators are thrown into algorithmic coliseums with no margins for failure, their output flattened into metrics before they’ve even found their voice.

And yet, the privileged still preach platform meritocracy. They gesture toward virality as if it’s a function of quality, not a function of pre-baked visibility and infrastructural leverage. Their anecdotal successes become data points in a pseudo-democratic fantasy: “Look, anyone can make it!”—ignoring that the ladder they climbed has since been greased, shortened, and set on fire.

This is the classic error of assuming one’s exceptional position represents the universal case. It’s the same logic that produces bootstrap mythology, just dressed in digital drag. And worse, it becomes policy—informing the design of platforms, the expectations of audiences, and the funding strategies of gatekeepers who sincerely believe the system is “working,” because the same five names keep showing up in their feed.

The Privilege Blind Spot isn’t just an individual failing—it’s a recursive error in the feedback loop between platform logic and human perception. Those who benefit from the system are the most likely to defend it, and their defenses are the most likely to be amplified by the system itself. The result is a self-affirming bubble where critique sounds like bitterness and systemic analysis is dismissed as sour grapes.

And all the while, a generation is being told they just need to try harder—while the game board is being shuffled beneath their feet.

FALSE BINARIES AND RETHORICAL DEVICES

Look at the state of tech discourse in 2025. It thrives on compression—not just of data, but of dialogue. Complex, multifaceted issues are routinely flattened into false binaries: you’re either for the algorithmic future, or you’re a Luddite dragging your knuckles through a sepia-toned fantasy of analog purity. There is no spectrum. There is no ambivalence. You’re either scaling or sulking.

This isn’t accidental. It’s a design feature of rhetorical control, a kind of epistemic sorting mechanism. By reducing debate to binary choices, the system protects itself from scrutiny—because binaries are easier to monetize, easier to defend in a tweet, easier to feed into the recommendation engine. Nuance, by contrast, doesn’t perform. It doesn’t polarize, and therefore it doesn’t spread.

Within this frame, critique becomes pathology. Raise a concern and suddenly you’re not engaging—you’re resenting. Express discomfort and you’re labeled pretentious or moralizing. This is not an argument—it’s a character assassination through taxonomy. You are no longer responding to an issue; you are the issue.

The tactic is elegantly cynical: shift the ground from substance to subject, from the critique to the critic. By doing so, no engagement with the actual points raised is necessary. The critic’s motivations are interrogated, their tone policed, their credentials questioned. Are they bitter? Are they unsuccessful? Are they just nostalgic for their moment in the sun? These questions serve no investigative purpose. They are not asked in good faith. They are designed to dismiss without having to refute.

And so the discourse degrades into a gladiatorial match of vibes and affiliations. You’re either “pro-innovation” or “anti-progress.” Anything in between is seen as suspiciously undecided, possibly subversive, certainly unmonetizable.

But reality, as always, is messier. You can value creative automation and still demand ethical boundaries. You can acknowledge the utility of machine learning while decrying its exploitative training practices. You can live in 2025 without worshiping it. But good luck saying any of that in public without being shoved into someone else’s false dichotomy.

Because in the binary economy of attention, the only unacceptable position is complexity.

THE SUSTAINABILITY QUESTION GOES UNANSWERED

The most glaring omission in today’s techno-optimistic frameworks is the sustainability question—the question that should precede all others. How do we maintain creative ecosystems when the economic foundations that supported their development are being quietly dismantled, restructured, or outright erased?

Instead of answers, we get evasions disguised as aphorisms. “Creativity has always been remix.” “Artists have always borrowed.” These are bumper-sticker retorts masquerading as historical insight. They dodge the real issue: scale, speed, and asymmetry. There’s a material difference between a poet quoting Virgil and a multi-billion-parameter model strip-mining a century of human output to generate low-cost content that competes in the same attention economy.

It’s like comparing a neighborhood book exchange to Amazon and declaring them functionally identical because both involve books changing hands. One operates on mutual trust, informal reciprocity, and local value. The other optimizes for frictionless extraction at planetary scale. The analogy doesn’t hold—it obscures more than it reveals.

When concerns about compensation and sustainability are brushed aside, what’s really being dismissed is the infrastructure of creative life itself: the teaching gigs, the small grants, the advances, the indie labels, the slow growth of a reputation nurtured over decades. These were never utopias, but they were something—fragile, underfunded, imperfect somethings that at least attempted to recognize human effort with human-scale rewards.

The new systems, by contrast, run on opacity and asymmetry. Scrape first, apologize later. Flatten creators into “content providers,” then ask why morale is low. Flood the zone with derivative noise, then celebrate the democratization of mediocrity. And when anyone questions this trajectory, respond with a shrug and a TED Talk.

Here in 2025, we are awash in tools but impoverished in frameworks. Every advance in generative output is met with diminishing returns in creative livelihood. We can now generate infinite variations of style, tone, and texture—but ask who gets paid for any of it, and the answer is either silence or spin.

A culture can survive theft. It cannot survive the removal of the incentive to create. And without some serious reckoning with how compensation, credit, and creative labor are sustained—not just applauded—we’re headed for an artistic monoculture: wide as the horizon, but only millimeters deep.

BEYOND NAIVE OPTIMISM

Giving tech the benefit of the doubt in 2025 isn’t just optimistic—it’s cringe. At this point, after two decades of platform consolidation, surveillance capitalism, and asymmetrical power growth, insisting on a utopian reading of new technologies is less a sign of hope than of willful denial.

We’ve seen the pattern. It’s not theoretical anymore. Power concentrates. Economic rewards stratify. Systems optimize for growth metrics, not human outcomes. Every technological “disruption” is followed by a chillingly familiar aftershock: enclosure, precarity, and a chorus of VC-funded thought leaders telling us it’s actually good for us.

A more intellectually honest position would start from four simple admissions:

Power asymmetries are not accidental. They are baked into the design of our platforms, tools, and models. Tech doesn’t just reveal hierarchies—it encodes and amplifies them. Pretending otherwise is not neutrality; it’s complicity. Creative exchange is not monolithic. Not all remix is created equal. There is a difference between cultural dialogue and parasitic ingestion. Between quoting a line and absorbing an entire stylebook. Lumping it all under “derivative culture” is a rhetorical dodge, not an analysis. Economic sustainability is not a footnote. It is the core problem. A system that enables infinite production but zero support is not innovation—it’s extraction. You cannot build a vibrant culture by treating creators as disposable training data. Perspective is positional. Your comfort with change is a function of where you stand in the hierarchy. Those at the top often see disruption as an opportunity. Those beneath experience it as collapse. Declaring a system “fair” from a position of inherited advantage is the oldest trick in the imperial playbook.

The future isn’t predetermined by historical analogy or corporate roadmap. It is shaped by policy, ethics, resistance, and the thousand small choices we make about which technologies we adopt, fund, regulate, and refuse. To pretend otherwise is to surrender agency while cosplaying as a realist.

What we need now is not uncritical optimism—nor its equally lazy cousin, reflexive rejection. We need clear-eyed analysis. Frameworks that hold contradictions accountable, rather than celebrating them as sophistication. A discourse that recognizes both potential and peril, without using potential as a shield to deflect every legitimate concern.

Because here’s the truth: the people most loudly insisting “there’s no stopping this” are usually the ones best positioned to profit from its advance. And the longer we mistake their ambivalence for balance, the more we allow them to write a future where complexity is flattened, critique is pathologized, and creativity becomes little more than algorithmic residue.

The choice is not between embrace and exile. The choice is whether we build systems worth inheriting—or ones we’ll spend decades trying to undo.

TL;DR: THE DOUBLETHINK DOCTRINE

Tech discourse in 2025 is dominated not by clarity, but by a curated fog of contradictions—positions that would collapse under scrutiny in any other domain, yet somehow persist under the banner of innovation:

• AI is not comparable to masters like Lovecraft—yet its outputs are breathlessly celebrated, anthologized, and sold as literary breakthroughs.

• All creativity is derivative, we’re told—except, of course, when humans do it, in which case we bring ineffable value and should be spared the comparison.

• Compensation concerns are naïve, critics are scolded—right before the same voices admit creators deserve payment, then offer no credible path forward.

• We’re told to develop ‘genuine’ relationships with AI, while simultaneously reminded that it has no intent, no mind, no soul—demanding a kind of programmed cognitive dissonance.

• AI alone is exempt from the ‘good servant, bad master’ principle that governs our relationship with every other tool we’ve ever built.

• Safety research is hysteria, unless it’s being conducted by insiders, in which case it’s suddenly deep, philosophical, and nuanced—never mind the overlap with everything previously dismissed.

These are not accidental lapses in logic. They are deliberate rhetorical strategies—designed to maintain forward momentum while dodging accountability. Together, they form what can only be called the Doublethink Doctrine: a framework that allows its proponents to inhabit contradictory beliefs without consequence, all in service of technologies whose long-term effects remain unsolved and largely ungoverned.

This isn’t optimism. It’s intellectual surrender dressed as pragmatism. And the longer we allow this doctrine to define the debate, the harder it becomes to ask the questions that actually matter.

CODA

Trump wasn’t an anomaly. He was a prototype. A late-stage symptom of legacy systems imploding under their own inertia—hollow institutions, broadcast-era media, industrial politics held together by branding, grievance, and pure spectacle. He didn’t innovate. He extracted. Extracted attention, legitimacy, airtime, votes—then torched the machinery he climbed in on.

And now here comes Tech, grinning with that same glazed stare. Different vocabulary, same function. Platform logic, data laundering, AI hallucinations sold as wisdom—another system optimized for maximum throughput, minimum responsibility. Where Trump strip-mined the post-war order for personal gain, these systems do it to culture itself. Both operate as parasitic feedback loops, surviving by consuming the very thing they pretend to represent.

If you can’t see the symmetry, you’re not paying attention. One is a man. The other is a machine. But the architecture is identical: erode trust, flatten nuance, displace labor, accumulate power, and let the collateral damage write its own obituary.

Trump was the ghost of broadcast politics; AI is the apex predator of posthuman creativity. Both are outcomes, not outliers. Both are extraction engines wrapped in the costume of progress.

And if that doesn’t make you nervous, it should.